The African Development Bank issues EUR 1.25 billion 2.25% 7-year Global Benchmark Social Bond due 14 September 2029

On Wednesday 7th September 2022, the African Development Bank (“AfDB”), rated Aaa (Moody’s) / AAA (S&P) / AAA (Fitch) / AAA (Japan Credit Rating), launched and priced a new EUR 1.25 billion 7-year Global Benchmark transaction, in a Social Bond format, due 14 September 2022. The bond pays a coupon of 2.250% with a re-offer yield of 2.310%.

The new 7-year EUR transaction marks the African Development Bank’s second EUR Global Benchmark in 2022, following the EUR 1 billion 5-year transaction issued in March, extending further the Bank’s EUR curve. Additionally, this new line brings a new liquid and on-the-run reference point in the 7-year part of AfDB’s EUR curve, refreshing a key benchmark maturity, which AfDB last visited in 2017.

By issuing social bonds to finance socio-economic development in its regional member countries, the Bank is advancing its mission and strategy – to spur sustainable economic development and social progress in Africa – and is capitalizing on its strong track-record of financing projects with strong social impact on the continent. The eligible projects to be financed with the proceeds of this new EUR-denominated Social Bond are expected to lead to poverty reduction and job creation, as well as inclusive growth across age, gender and geography, thus improving the quality of life for the people of Africa.

The AfDB’s mandate for a new 7-year EUR-denominated Global SEC-Exempt Benchmark was announced on Tuesday 6th September 2022, at 13:00 London time, with the issuer seizing the final clear window available in the EUR market before the ECB’s September meeting on Thursday.

Books officially opened the following morning, on Wednesday 7th September 2022, at 8:00 London time with Initial Price Thoughts released at mid-swaps – 2bps area. Investor demand was robust from the outset with the orderbook growing in excess of EUR 1.8 billion by 9:35 London time, supporting AfDB’s move to set the spread tighter at mid-swaps – 3bps with books to go subject at 10:30 London time. The final mid-swap spread implied a new issue concession of 2bps relative to AfDB’s EUR curve.

Investor interest continued to grow with the book closing in excess of EUR 2.3 billion with 71 investors participating in the offering whilst the quality of the book firmly supported the launch of a EUR 1.25 billion transaction. Notably, at EUR 2.3 billion, the deal’s orderbook represents AfDB’s largest ever book for a EUR benchmark transaction.

Shortly thereafter at 14:10 London time, the transaction officially priced at mid-swaps – 3bps, equivalent to a reoffer yield of 2.310% and a spread of 96.4bps vs. the DBR 0.00% August 2029 benchmark.

Distribution statistics:

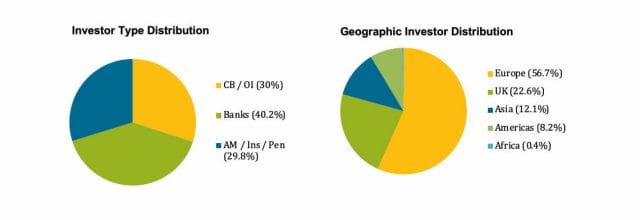

The geographical distribution highlights a diversified investor base approximately with the majority of the book from Europe (56.7%), followed by the UK (22.6%), Asia (12.1%), Americas (8.2%) and Africa (0.4%)

In terms of investor type, the high quality orderbook was predominantly allocated to Banks (40.2%) and Central Banks/Official Institutions (30%) and whilst Asset Managers / Insurance / Pension Funds (29.8%), rounded off the remainder of allocations.

Bond Summary Terms:

|

Issuer: |

African Development Bank (“AfDB”) |

|

Issuer Rating: |

Aaa / AAA / AAA / AAA (All Stable) |

|

Size: |

EUR 1.25 billion |

|

Pricing Date: |

7 September 2022 |

|

Settlement Date: |

14 September 2022 |

|

Maturity Date: |

14 September 2029 |

|

Coupon: |

2.250% |

|

Spread to mid-swaps: |

-3 basis points |

|

Spread to benchmark: |

+96.4 basis points |

|

Re-offer price: |

99.616% |

|

Re-offer yield: |

2.310% |

|

Lead Managers: |

Barclays, Citi, JP Morgan and Société Générale |

|

ISIN |

XS2532472235 |