Warner Music’s Temi Adeniji on the rise of music from Africa – and ‘a recalibration of what it means to create pop music’

Listen above or click here to access this podcast on your preferred streaming service. Music Business Worldwide’s podcasts are supported by Voly Entertainment.

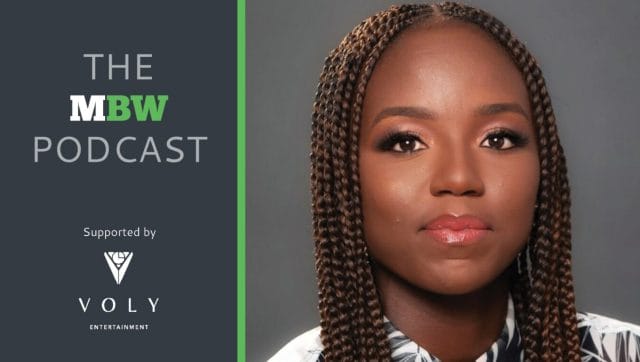

On the latest Music Business Worldwide [332 articles]” href=”https://www.musicbusinessworldwide.com/companies/music-business-worldwide-2/”>Music Business Worldwide podcast, MBW founder Tim Ingham is joined by Temi Adeniji, Managing Director of Warner Music Africa and SVP of Sub-Saharan Africa at Warner.

Africa, especially Sub-Saharan Africa, is already a major global music industry story with huge potential for the future. On the music-making side of things, the continent has produced global hits and superstars in recent years including the likes of Burna Boy and Ckay from Nigeria, Tyla from South Africa, and many others.

As Temi points out in this discussion, the influence of African nations on modern music goes far beyond these rising stars, especially when you take into account genres such as Afrobeats and amapiano.

Based in Johannesburg, Temi has been instrumental in a number of initiatives from Warner Music Group [2,839 articles]” href=”https://www.musicbusinessworldwide.com/companies/access-industries/warner-music-group/”>Warner Music Group in Africa in recent years, including its partnership in Nigeria with Chocolate City, signed in 2019, as well as its acquisition of distributor Africori in 2022, and other deals such as Warner’s partnership with East African artist Diamond Platnumz and his label WCB-Wasafi, in 2021.

On these and other deals, Temi has worked closely with Warner’s President of Emerging Markets, Alfonso Perez-Soto.

Temi hasn’t always been Africa-based. She was born in Nigeria, but moved to the US as a child, where she later graduated from Princeton University and then Columbia University, before building a successful career in law. She then joined Warner Music Group in New York in 2016, working across international strategy and operations, before relocating for her current job in Johannesburg in 2021.

On this podcast, Temi discusses the potential of various African markets, both in terms of the music being made there and in terms of commerce. She also talks about Warner’s own strategy in the region, and the general commercial excitement surrounding nations like Nigeria, where, as an example, Universal Music Group [3,541 articles]” href=”https://www.musicbusinessworldwide.com/companies/universal-music-group/”>Universal Music Group recently made a nine-figure investment into Mavin Records.

Read an abridged/edited transcript of Temi Adeniji and Ingham’s conversation below, or listen to the full podcast – either above, or on your preferred service…

What have been the two or three biggest stories in music across Africa since you started your role in Johannesburg?

I think the first one is [these] pervasive global hits coming from the continent over the last three, four years. So in 2020, you had Jerusalema, which is from South Africa, an artist called Master KG, and then you had Ckay in 2021/2022 with Love Nwantiti, and then Rema with Calm Down, 2022/2023. And then the most recent being Tyla with Water, and winning the Grammy so early on in her career.

What you see is just a consistent growth story here. Each of those songs was bigger than the previous one. But I think what that speaks to is just how fervent the appetite for music from the continent is, from across the world. I think for us, we kind of saw this ahead of time. I think a lot of the industry had been talking about Afrobeats for a really long time, but really started to see the numbers in the last couple years, and I think that’s been really encouraging.

“I think it is great to see artists being influenced by each other from across the continent. Being a Pan-African, I think there’s something really powerful about that story.”

The second thing, I think, is the rise of amapiano, I think since 2019. Amapiano has really come through as, commercially, one of the continent’s biggest exports. It is a South African music genre, for those who don’t know, and a lot of the streams – much like a lot of the content from the continent – is really seeing huge growth in Europe and Asia and in North America. I think between 2019 and 2023, there was over 500% growth on Spotify [3,788 articles]” href=”https://www.musicbusinessworldwide.com/companies/spotify/”>Spotify with respect to the genre.

And I think that comes [down] to just being rooted in dance and rhythm. The genre is super versatile. There has been some discussion around the fact that a lot of Nigerian Afrobeats was co-opting the amapiano structure over the past couple of years, and it’s been [often] seen from a negative light. But I think there is some positivity along with that. I think it is great to see artists being influenced by each other from across the continent. Being a Pan-African, I think there’s something really powerful about that story. As long as the credit gets placed where it’s deserved, I think it’s a great story to show all the different parts of the continent really being influenced by each other to create something really extraordinary. So for me those are the two main things that have really cut through as really, really amazing stories from the continent since I’ve taken this role.

I would say the biggest story of Sub-Saharan Africa, from the export point of view, continues to be Nigeria, both in terms of domestic trade revenues and culture. When you look at Nigeria today, which I know is within your remit, how much bigger can its story get in music, both domestically and globally?

I often say that what we’re witnessing right now is just a recalibration of what it means to create pop music, so I don’t necessarily see it as just music from Nigeria. I see the artists and the creatives from Nigeria really influencing what pop music means today. I think you’re seeing that across a bunch of different regions.

Latin music is obviously having its moment, and has been having a moment over the past couple years, and I think all it means is that it’s not just going to be an [Anglo-centric] idea of pop, and everything is going to become mixed in. You’ll have influences from India, Latin America, Africa, and all the sounds from all these different places will really become part of this pop milieu, and I think that’s where we’re going. I think we’re moving to a place where the sounds are really democratized.

As I was saying previously, artists are influencing each other, genres are taking inspiration from other genres, and it’s all just what pop music is seen as. But I think for me, the most important thing to note is that Africa will be playing a very big role in this evolution of what pop is.

Part of that is the economic impact that the country itself – the music listeners in the country itself – will have on the global music industry. Not just the cultural and musical influence, but actually commercial influence. IFPI [556 articles]” href=”https://www.musicbusinessworldwide.com/companies/ifpi/”>The IFPI RECENTLY REPORTED that Sub-Saharan recorded music revenues grew by 24.7% in 2023, fueled by a 24.5% rise in paid streaming services. It’s really a hot territory. From your perspective, what needs to happen domestically to accelerate the commercial potential of the region?

Sub-Saharan Africa, as you said, experienced over 20% growth, it’s valued about $92 million, which is approximately $20 million in year-on-year growth. It is the only region to exceed 20% [but] it is a very low base. Keep that in mind. As it stands, there are about 40 million subscribers, both paid and free, across all the different platforms, in Sub-Saharan Africa. South Africa is the largest market, around 77% of the regional revenues, and then Nigeria is around 9 million [subscribers, with] about 45% growth from the previous year.

If you think about the population of Sub-Saharan Africa being about 1.2 billion, we have about 3% penetration. That’s not even scratching the surface of what the potential is here. If we get to 30% penetration, with everyone paying an approximate value of sort of 50 cents [per month] we will have an additional $160 million in revenue for the industry. That is super significant. So I think when we think about the territory, we really think about the potential that we can see if we continue to see even what I would say is modest growth. But obviously it’s exponential growth [in] the region.

My experience has revealed two main obstacles to achieving scale. One is just an underdeveloped music ecosystem in terms of PROs [performance rights organizations] and CMOs [collective management organizations]. South Africa’s the only country in the region with sophisticated and effective organizations that are doing collections, and most of the other countries are plagued with CMOs and PROs that are in competition against each other. There’s mismanagement, etc. It’s really problematic, because it really does distort the value of the industry. And it also means that artists and rightsholders don’t have a functioning apparatus through which to get paid fairly. So for me, that is probably one of the most important barriers to growing the domestic market.

“For me, having a functional regulatory edifice has both implications for the industry, but also socio-cultural implications in terms of how artists can approach making music.”

And then the second is obviously [mobile] data costs, which I talk about all the time.

I like to think about this in the context of my experience in India. So between 2017 and 2018… I took a number of trips to India, and that really revealed to me the main factor that underpinned the rapid increase of [music] consumption in India was an extraordinary countrywide campaign [to expand high-speed internet]. India first got high-speed internet around the early 2010s, and largely at a pretty standard pace, but then in 2016, you had Reliance Jio offer[ing] customers 4Gb of data for free, for six months. And the results were really dramatic. Within six months of the launch, India became a top mobile data user.

So I use this as a marker for Africa, because… this gave me a little bit of hope about where the continent could go, but also gave a view of how important this campaign [was in] expedit[ing] the growth of the Indian market from a telecoms perspective. But [it] also impacted music because you had folks in villages who had never had access to data and, now [were] able to access data, and surfing the internet became sort of [like] buying a cup of tea, if you will.

[However,] a really good friend of mine, the Managing Director of Spotify [for Sub-Saharan Africa], Jocelyn [Muhutu-Remy], said ‘Well, you have to remember the difference between Sub-Saharan Africa and India is population density.’ The cost of putting something like [what Reliance Jio did in India] in place somewhere like Sub-Saharan Africa is astronomical, compared to India. We’re looking at a population density of about 40 [people] per square kilometer in Sub-Saharan Africa, versus 470 per square kilometer [in India]. So there are a number of different factors that make it really challenging to increase internet penetration and to reduce the cost of data.

Both of these conditions… really exacerbate the issue of this being an export driven market. In and of itself, that’s not a problem. But I think it really means that countries outside of the territory wield an outsized power over the continent, even if its covert, you know what I mean? So I think for me, having a functional regulatory edifice has both implications for the industry, but also socio-cultural implications in terms of how artists can approach making music.

Let’s talk about Warner specifically for a second. What, in your mind, differentiates Warner’s strategy in Africa, especially in terms of global competitors?

Non-global competitors are also getting really interested in the territory, and it’s a lot of money. So… all of them are important, but I will say that I have no idea how our strategy is different from our competitors, because we don’t focus on the competitors. We just focus on what our strategy is, and what it isn’t.

So I can tell you that we – and by that I mean, myself and Alfonso – started crafting the strategy for Africa around 2017. We were really late movers, so we were clear that, in order to make up for lost time, we wanted to really focus on finding fit-for-purpose businesses already operating on the ground. And so in the last couple of years, we’ve covered a lot of ground via accretive investments, which have given us a really great foundation to become real players in the market.

We always engage in a thoughtful and inventive way, and we don’t really worry too much about what everyone else is doing. Our strategy was definitely not to just open new offices. It’s always been to take the time to work with local partners, Africori, Chocolate City.

“There’s no one-size-fits-all approach, as it’s a hugely diverse region with different cultures, languages, all with really exciting local music scenes.”

We really want to get as much as we can and add as much value as we could. I think we’ve done a really great job of that. Part of my coming here was a full-circle moment around what we had planned from 2017. We’ve made several different investments, and then in 2021, it was me coming to try to start bringing things together and lay a real foundation for what we could build on top of and that’s where we are now.

So I think we’ve just been taking it bit by bit, really focusing on region by region. There’s no one-size-fits-all approach, as it’s a hugely diverse region with different cultures, languages, all with really exciting local music scenes. You’ve got East Africa, you’ve got Tanzania, Kenya, you’ve got Nigeria, Ghana and West Africa, South Africa, Zimbabwe. There’s just so much richness in terms of the culture, and I think we’ve always tried to have a view of that as we’ve been moving forward, in order to build commercial plans that take into account all these idiosyncrasies.

I’ve heard that there was a period in the past where the major music companies were seen to have swept in to the continent, and they stocked up and invested and then they ended up folding down their operations, and obviously that can be quite damaging, that kind of rushing in, investing, and then closing down. What’s different about that era versus this era? Do you have more confidence in this era of multinational music company investment in the region than that we have seen in the past?

I definitely think the approach is different now. Previously it was to just come here, set up shop and really take. And I think where it’s different now is [there is] a view of actually investing in entrepreneurs who’ve taken a lot of risks to build businesses in a really challenging environment. I think that’s definitely something that’s been positive.

I think a lot of the majors and players in the market work very closely with the IFPI, and organizations like the IFPI are super important and trying to actually build on the ground. I sit on the [IFPI’s] Sub-Saharan African committee. And through that, we’ve actually set up charts in South Africa and most recently Nigeria, and these don’t seem like a huge deal, but for me, these are the nuts and bolts of what it means to have a functional music industry.

And as we work together, I think that we can really cut through and build something that’s more sustainable than what it was last time, because that was, by and large, completely export-driven from both a commercial and also from a cultural perspective. Whereas now there is some focus on trying to build on the ground and trying to make sure there are organizations on the ground that are trying to ensure that this… industry is working appropriately.

There have been some statistics out lately showing the rise of non-English-language music. Luminate said that 55% of the top 10,000 tracks streamed globally in 2023 were English language, down from 67% a few years earlier. And Spotify said that said that more than half of artists who are earning over $10,000 from its platform globally lived outside of territories where English was the primary language. So it looks inevitable that non-English-language tracks will become the majority of the top 10,000 tracks in 2024. We could be looking at a milestone year. How are these kinds of statistics, from your perspective, changing the global music business, and what opportunities do they open up?

[We started seeing] this in Europe around the 2016, 2017 mark, where you were seeing a huge shift from consumption of Western and English content, in countries like Italy, Germany and France, really moving over to more local language consumption. So these indicators have been happening for almost eight, nine years and now you’re starting to see it with the penetration of music from all these different emerging markets regions.

It’s a process that I often refer to as “the great de-Westification,” but it goes back to what I was saying about the recalibration of what it means to create pop music. I think in terms of influence, you’re seeing countries with huge demographic numbers, just huge populations, really starting to have their [day in the sun] and starting to influence and show the influence of other markets that are non-Anglo.

“I think in terms of influence, you’re seeing countries with huge demographic numbers, just huge populations, really starting to have their [day in the sun] and starting to influence and show the influence of other markets that are non-Anglo.”

Something that I’ve been keenly aware of – and it’s something that I think is a great thing – [is] it shows the diversity around the world. When different regions are taking influence from other regions, I think it’s a fantastic thing. I think it’s the impetus for why I decided to pack up and move out to Jo’burg… I wanted to be part of that story. I think it’s a really powerful story. I think it’s a righting of decades, or a huge amount of time, where Western and Anglo content has been really dominant, which was just where we were.

But I think we’re starting to see a shift. And I think that shift is more reflective of where the world is and what the world has to offer, from a global perspective. So I think it’s amazing. I’m grateful to be part of the story. I’m grateful that I was able to get this opportunity… Within the company, the view of Africa and the emerging markets has completely shifted, there’s a huge amount of focus on these territories as real growth areas. So I think it’s amazing.

MBW’s podcasts are supported by Voly Entertainment. Voly’s platform enables music industry professionals from all sectors to manage a tour’s budgets, forecasts, track expenses, approve invoices and make payments 24/7, 365 days a year. For more information and to sign up to a free trial of the platform, visit VolyEntertainment.com.Sourced From Nigerian Music