African Development Bank launches $2.5 billion 0.875% Global Benchmark due 23 March 2026

The African Development Bank, rated Aaa/AAA/AAA/AAA (Moody’s/S&P/Fitch/Japan Credit Rating, all stable), has launched and priced a $2.5 billion 5-year Global Benchmark bond due 23 March 2026, its first $ benchmark of the year.

The new transaction represents AfDB’s largest 5-year $ Global Benchmark ever issued, as well as its largest orderbook achieved for a 5-year benchmark transaction. With the final orderbook closing in excess of $3.6 billion (excluding Joint Lead Managers (JLM) interest), and 72 investors participating, the success of this 5-year transaction is a clear vote of confidence from investors in AfDB’s AAA credit. Global asset managers and bank treasuries were key contributors to the strong dynamic of the transaction and played a key role in its success, illustrating their solid partnership with the AfDB.

The AfDB’s mandate for a 5-year $ Global Benchmark was announced on Monday 15 March, at 12.04pm London time with Initial Pricing Thoughts (IPTs) released at mid-swaps + 6 basis points (bps) area. The deal enjoyed robust investor demand from the outset as Indications of Interest (IOIs) from AfDB’s high quality investor base accumulated at a rapid pace, exceeding $2.4 billion (excluding JLM interest) overnight.

Books officially opened the following morning Tuesday 16 March, at 8.09am London time. Off the back of the large and high-quality IOIs, price guidance was revised to mid-swaps + 5bps area. The orderbook continued to grow throughout the morning, with investor demand approaching $3.4 billion by 10.50am London time, which allowed to set the spread at mid-swaps + 5bps. This level represents a new issue concession of only 1bp versus estimated fair value.

At 2.06pm London time, the quality of the orderbook allowed the transaction to be launched with a size of $2.5 billion, as the final orderbook closed in excess of $3.6 billion (excluding JLM interest).

Shortly thereafter at 3.37pm London time, the transaction officially priced at mid-swaps + 5bps, equivalent to a reoffer yield of 0.949% and a spread of 13.5bps vs the on-the-run 5-year US Treasury.

“This is our largest 5-year dollar benchmark transaction, and its success reflects the strong interest from our growing investors across the globe for the Bank’s credit story and the quality of its transactions”.

Hassatou Diop N’Sele, Group Treasurer, African Development Bank

Investor distribution statistics:

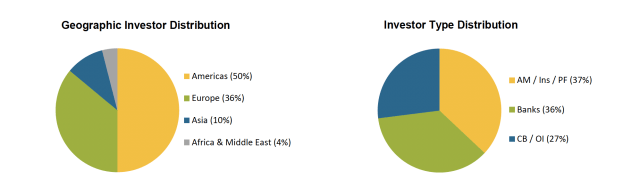

The transaction is yet another demonstration of AfDB’s extremely broad and high-quality investor base, with this bond well allocated across different geographies and investor types. Accounts from the Americas received 50% of allocations, Europe 36%, Asia 10% while investors from Africa and Middle East rounded out the remainder of the book with 4% of the allocations. By investor type, Asset Managers/Insurance/Pension Funds led the book with 37% of allocations, followed by Banks with 36%, while Central Banks/Official Institutions took 27%.

Transaction details:

|

Issuer: |

African Development Bank (“AfDB”) |

|

Issuer Rating: |

Aaa / AAA / AAA / AAA (All Stable) |

|

Size: |

$2.5bn |

|

Pricing Date: |

16 March 2021 |

|

Settlement Date: |

23 March 2021 |

|

Maturity Date: |

23 March 2026 |

|

Coupon: |

0.875% |

|

Spread to mid-swaps: |

+5bps |

|

Spread to benchmark: |

+13.5bps |

|

Re-offer price: |

99.639% |

|

Re-offer yield: |

0.949% |

|

Lead Managers: |

Barclays, BMO Capital Markets, BNP Paribas, Goldman Sachs International, Societe Generale, |

|

Co-Lead Manager: |

Castle Oak Securities |

|

ISIN: |

US00828EEE59 |